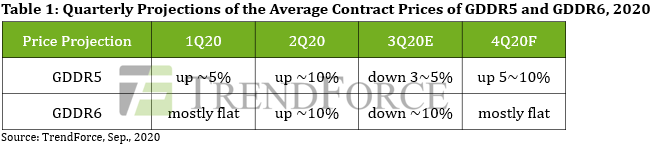

The lowered production capacity and high demand have resulted in a tight supply situation for GDDR5.

Spot prices of GDDR5 8Gb chips are 10% higher than 3Q20 contract prices.

Therefore, the supply of GDDR5 is expected to remain tight throughout the transition period while GDDR5 contract prices are highly likely to enter an upsurge ahead of other DRAM products.

Demand for GDDR6 is expected to take off thanks to its deployment in the upcoming game consoles (i.e. Xbox Series X and PS5).

Furthermore, GDDR6 has been adopted for new products across all price segments of the graphics card market.

The demand for the next-generation series is going to keep rising as the current period of product transition is coming to an end.

The supply of GDDR6 products is not as tight as before because DRAM suppliers are gradually reallocating their production capacity for graphics DRAM to GDDR6 products.

In spot trading, the average transaction price of GDDR6 8Gb chips now stands around the same level as the average contract price of the same product for 3Q20.

Due to the lack of a noticeable difference with spot prices, contract prices of GDDR6 products are projected to stabilize and will unlikely experience another double-digit QoQ decline in 4Q20.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News